FED in black hole

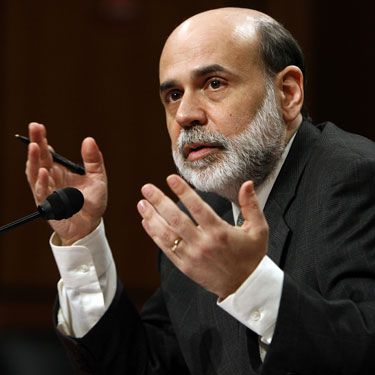

In order to explain the relations ruling Dollar, let me use an example of the pond, where the carps are being reared. USA are that huge pond, where chairman of the FED, Ben Bernanke is rearing his carps. Since 2008, the level of the water has started to go down drastically. People have started to de-leverage or pay their debt in a hurry and cease to take new loans. On top of that, the deficit which was bothering the pond for years, started to increase – one could say that real drought had become. More water was flowing out than what was flowing in by the rain. Bernanke first started to carry the water in little buckets from his house, what could be paralleled with continuous rate cuts down until zero. Much to his despair, these constant replenishing with buckets of water came out short and the pond was still running dry. First carps started to swim upside down (the fall of Lehman Bros, Countrywide, Freddie & Fannie Macs etc.) What did our carp breeder do?

He decided that from then on, he would connect the hose and he would pour the water constantly so the pond would not dry any more. Unfortunately an incredible drought was still devastating and even intense pouring could not be enough. If it not had been enough for lack of rain, the gap in the ground was increasing and the water was leaking in. He decided to switch off the hose in 2010 for the first time. He wanted to check if somehow water stopped to leak. Yet, to his outcry, level of water started to go down dramatically as soon as he cut its artificial supply. He was restlessly looking at the sky but the killing sun was still glaring…Then he restored pouring water with the hose and to his joy, the level of water got back up to normal. In 2011 he wanted once again to check if once the hose had been off, nothing could happen and again screwed (or hosed in this regard)…he finally gave up and decided that perhaps he would never switch the hose off, or else not until 2015. The year 2012 has passed and to his great surprise and unhidden euphoria, the much anticipated rain did finally occurre!!! What is the purpose of this allegory and how to interpret its symbols? Level of water is total amount of money in economic system. Why does the water leak in USA?First of all – trade deficit and interests paid to creditors (China, Japan, Russia, Arab states), which cannot be compensated by profits from overseas’ investments (e.g. Apple, Mc Donald’s etc.). This balance of all inflows and outflows in relation with foreign states is called current account, calculating quarterly in US. In III q 2012 current account deficit constituted 107 bln $. Therefore it was exactly half lower then record high of August 2006 (214 bln $). Still in the first quarter of 2012, the deficit made up 130 bln $, so the improvement was visible. The data for IV q 2012 are supposed to be even better, thanks to rising output of fracking oil and gas, making USA energy independent.

Secondly, since 2008 the households have been permanently de-leveraging (paying their debts and withholding to take new loans). It caused evaporation of as much as 1,4 trylion (1400 bln) USD out of the system!. Throughout last few years, 200-300 bln USD declined on yearly basis. Adding on top of that, account current deficit (annual) and the total accumulated black hole in American economy makes up to nearly 1 trylion yearly (83 bln per month)!What happened in IV q 2012 what caused the total change of paradigm? Now, as I mentioned above, after almost 5 years of great drought, the rain did finally occurred. It is not any impressive fall, however it shows gradual return to normal. What is the rain that brings Bernenke’s relief? In IV quarter of 2012, for the first time for nearly 5 years, the credit of American households started to rise again. It was a gain of about 30 bln USD in comparison to III quarter of 2012, but it is still better than nothing. Even if such a mediocre improvement was sustained in the long run, it would reduce the hole by 120 bln a year. Teaming up with falling current account deficit (100 bln less than previously), we are getting reduction of the black hole by half (520 bln less of a leak). But the hole of 480 bln USD are still left standing in American economy, that one must patch somehow. Since Bernanke did not yet disconnect his water hose and is pumping up to as much as 85 bln USD, so we are now having approximately 45 mld USD of surplus on the monthly basis! The level of water has risen and soon it would be able to break the maximum and critical mark – then it flows away and killed all the carps… Ben Bernanke is ahead of critical decision, which he must take not in few months but right now. If he miss this critical point, he would make the water flow out of his little pond and he would literally “throw the baby out with the bathwater”. During the next FOMC (Federal Open Market Committee) one can expect lively discussion on tapering quantitative easing program (QE3) of about half current bond purchases (about 20 bln USD - MBS-s not included!) and somewhere around midyear 2014 one can be almost sure to see it reduced to as low as 40 bln per mont or less. How it can effect US Dollar & stock markets? “The Green buck” will sure appreciate, along with not only tapering but also with reducing of current account deficit and increase of US households’ credit. (more credit = bigger demand for the debt currency) Stock market will go higher despite Dollar appreciation – at least in the USA. In Poland it would be problematic, since one cannot assess if stronger Dollar would compensate the fall of raw materials' prices. These raw materials like copper, coal and steel are the driving wheels of our economy and fracking shale gas is expected to be the one pretty much soon. Albert "Longterm" Rokicki Financial Markets Analyst www.longterm.pl To contact this author please write an email: kontakt@longterm.pl